Understanding the Basics of Landlord Insurance Coverage

Introduction and Outline: Why Landlord Insurance Matters

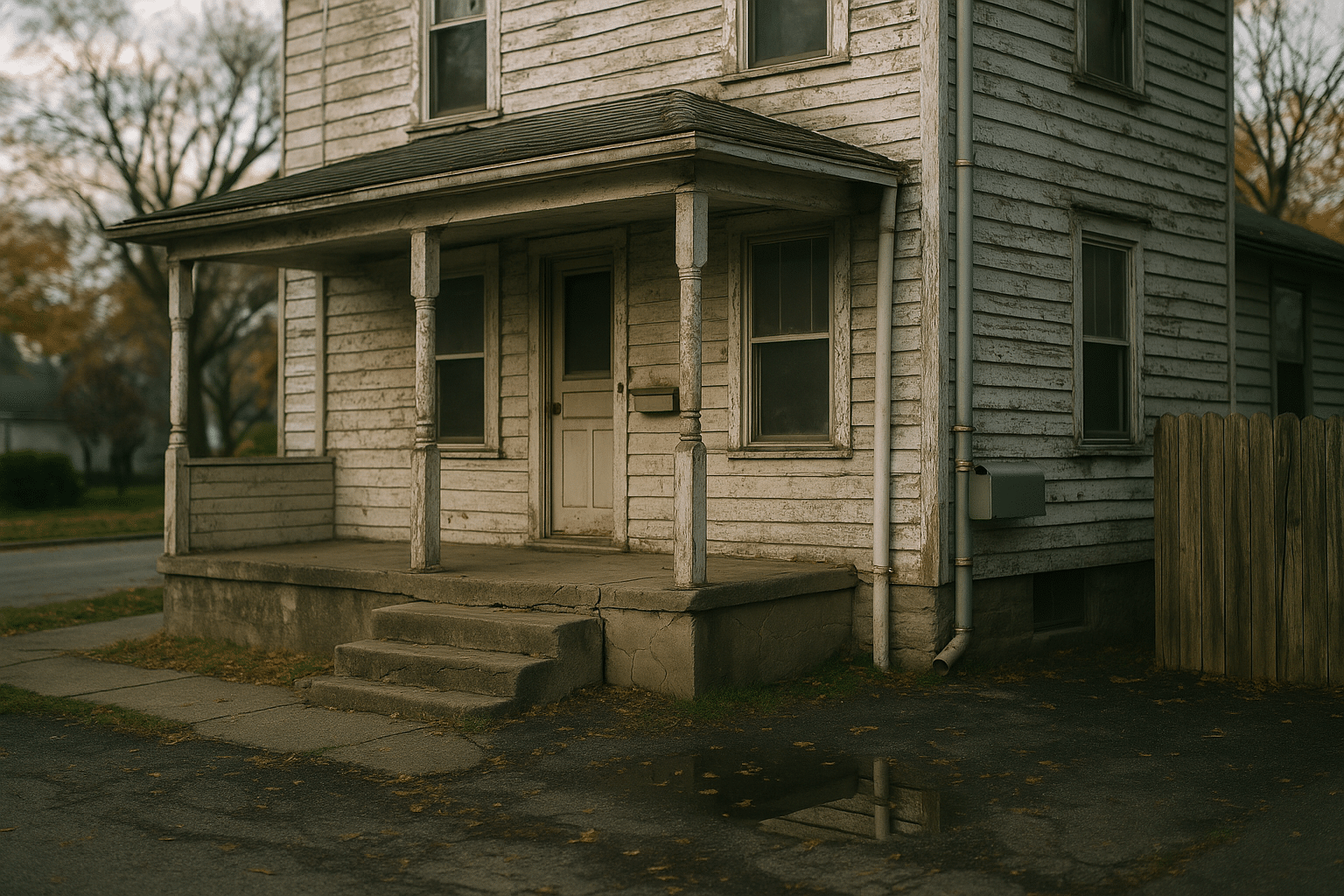

Landlord insurance isn’t just paperwork; it’s the shock absorber between a rental home and life’s potholes, from kitchen fires to slip‑and‑fall claims. If you rely on rental income, a solid policy can keep cash flow steady when repairs or lawsuits threaten to derail plans. Coverage, liability, and property details shape how you rebound after a loss. This guide maps those pieces, so you can choose protections that fit your buildings, tenants, and budget.

Rental housing is a business, even when it’s a single condo or a duplex on the corner. Business risks show up in two forms: sudden events that damage the structure, and allegations that a condition on the premises caused someone harm. Materials and labor costs have climbed in many regions over recent years, which can turn a “small” claim into a sizable rebuild. Meanwhile, injury claims tend to be infrequent but potentially severe, especially when complex medical care or lost wages are involved. That mix makes it essential to understand how policies are built, where the gaps sit, and which upgrades provide outsized value.

To make the topic workable, here is the roadmap we’ll follow—each point expands in the sections below with examples and practical takeaways:

– Coverage: What a typical landlord policy includes, the difference between named and open perils, loss of rent, exclusions that surprise owners, and endorsements that plug holes.

– Liability: How bodily injury and property damage claims work, defense costs, common hazards on rentals, and the role of umbrella policies.

– Property: Valuation choices (replacement cost vs actual cash value), coinsurance, code upgrades, roofs, vacancy, and claim settlement mechanics.

– Pricing and strategy: Factors that drive premium, how deductibles move the needle, risk improvements that can pay back, and a brief case comparison.

Along the way, you’ll see how a few decisions—such as water backup protection or ordinance upgrades—can change outcomes dramatically without breaking the budget.

Coverage: What’s Protected, What Isn’t, and How to Fill the Gaps

At its core, a landlord policy is built to protect the structure you rent out and the income it produces. The standard parts often include the dwelling itself, other structures on the lot, limited personal property used to service the rental (think lawn equipment or appliances you own), and coverage for lost rental income when a covered peril makes the unit uninhabitable. Policies are typically written on either a named‑perils form (listing exactly what’s covered) or an open‑perils form (covering everything except what’s excluded). The latter tends to be broader, but exclusions still matter a great deal.

Common covered causes of loss include fire, lightning, wind and hail, explosion, vandalism, and certain types of water damage from sudden pipe bursts. Yet important exclusions often catch owners off guard. Gradual leaks, wear and tear, maintenance issues, mold, earth movement, and external flood are usually excluded or severely limited. You can often add endorsements to address specific risks:

– Water backup: Helps with damage from backed‑up sewers or drains, a frequent source of messy, expensive claims in older buildings.

– Ordinance or law: Pays the extra cost to rebuild to current code after a covered loss, including demolition of undamaged parts if required.

– Equipment breakdown: Addresses sudden mechanical or electrical failures of systems like boilers or HVAC beyond standard policy terms.

– Short‑term rental or vacancy permits: Aligns coverage with actual occupancy patterns and reduces disputes at claim time.

Loss of rent (sometimes called loss of use for rentals) is a critical but often under‑appreciated piece. If a kitchen fire means three months without tenants, this coverage can replace the rent during the restoration period, keeping loan payments and taxes on track. Owners should confirm whether the limit is time‑based (for example, up to a set number of months) or capped by a dollar amount, and whether it applies to partial losses when only some units are down.

Deductibles shape both premium and behavior. Higher deductibles usually reduce cost, but pay attention to special deductibles for wind/hail or named storm in certain regions; these can be a percentage of the dwelling limit rather than a flat amount, shifting more cost onto the owner for weather events. Practical examples help illustrate the stakes:

– A burst second‑floor supply line can soak drywall, cabinets, and floors; with labor rates up and materials in short supply, even a “small” square footage can translate into a five‑figure estimate.

– A break‑in that damages doors and frames may be covered as vandalism, but stolen tenant belongings are not the owner’s claim; the tenant’s own policy would respond.

Takeaway: align coverage to the property’s age, systems, and the realities of your area. If your neighborhood has older sewer infrastructure or basement baths, water backup can be a smart add. If your building predates current energy or safety codes, ordinance or law coverage is often an outstanding value because code‑compliant rebuilds rarely match yesterday’s price tags.

Liability: Defending Your Business and Your Assets

Liability coverage addresses claims that a condition on your property caused bodily injury or damaged someone’s property. Think of icy steps, loose railings, uneven walkways, or poorly lit parking areas. When these incidents occur, the policy can fund legal defense and, if you are found legally responsible, pay settlements or judgments up to the limit. Medical payments to others, a smaller no‑fault coverage, may help with minor injuries and can sometimes defuse disputes before they escalate.

Two aspects deserve special attention. First, defense costs: in many policies, defense is provided in addition to the liability limit, but some forms can erode the limit as bills accrue. Knowing which structure you have matters, because legal fees can rise quickly when multiple parties are involved. Second, insureds and additional insureds: the policy typically protects the named owner entity, but managers or property‑holding companies may need to be specifically listed to avoid gaps. If you hire contractors, require proof of their own insurance and written agreements that clarify responsibilities; this is a practical way to prevent your policy from becoming the default for their mistakes.

Common rental hazards underline why liability limits should be meaningful:

– Stairs without secure handrails or with uneven risers create predictable fall risks.

– Loose carpeting, cracked sidewalks, or pooling water near entryways invite claims.

– Dogs on premises can raise exposure; some policies exclude certain animals or require compliance with local ordinances and fencing.

A real‑world rhythm of claims shows frequency is moderate but severity can spike. A simple trip can involve imaging, therapy, and time off work; claims with long recovery arcs can push into six‑figure territory, particularly when pain and suffering enter the conversation. For many landlords, pairing solid primary limits with an umbrella policy is a prudent, well‑regarded strategy. Umbrellas sit above the base policy, adding an extra layer that activates when primary limits are exhausted; they are often cost‑effective on a per‑million basis compared with raising primary limits alone.

Risk control reduces the chance of a claim and strengthens your defense if one occurs. Keep a short, repeatable checklist:

– Document seasonal inspections, snow and ice removal, and lighting checks.

– Photograph repairs before and after, and keep dated invoices.

– Install working smoke and carbon‑monoxide alarms and test them regularly.

– Use clear, fair leases that define responsibilities for tenants and guests.

Such habits improve safety and create a persuasive paper trail, which can help your carrier defend you effectively if allegations arise.

Property and Valuation: How Your Building Is Measured and Rebuilt

How your policy values the building determines how you recover after damage. Replacement cost aims to repair or rebuild with materials of like kind and quality without subtracting depreciation; actual cash value (ACV) subtracts depreciation and typically pays less upfront. In practice, replacement cost is preferred by many landlords because it mirrors what contractors will actually charge, especially during periods when labor and materials climb faster than general inflation. However, replacement cost usually comes with requirements: adequate limits and coinsurance compliance.

Coinsurance is a clause that encourages you to insure to a high percentage of true replacement value. If you underinsure, a formula can reduce your claim payment—even for partial losses. For example, insuring a building for far less than the estimated rebuild cost can trigger a penalty that leaves you funding a portion of the repairs out of pocket. Periodic reviews help: when roofs are replaced, porches rebuilt, or insulation upgraded, adjust limits to reflect reality. Estimators can be imperfect; use multiple inputs—recent bids, square‑foot costs in your area, and the complexity of finishes—to triangulate a defensible limit.

Two other provisions can make or break a claim:

– Ordinance or law coverage: When a loss occurs, building codes may require upgraded electrical, seismic anchoring, or fire separation that didn’t exist before. Without this endorsement, the extra cost may not be covered.

– Vacancy clauses: Extended periods of vacancy can limit or exclude coverage for vandalism and certain water losses. If you expect a longer turnover, speak with your agent about keeping coverage aligned with occupancy.

Roofs deserve special mention. In some regions, wind or hail endorsements settle roof claims at ACV for older roofs unless you’ve added coverage to restore replacement cost. Age, materials, and local weather drive this distinction. Documenting roof condition with photos and keeping receipts for maintenance or replacement can speed up claims and improve outcomes—adjusters pay close attention to evidence of prior wear and upkeep.

When a claim happens, the settlement process follows a predictable path: you report the loss, a field inspection is arranged, estimates are prepared, and an initial payment may be issued (often the ACV portion). As work proceeds and invoices are submitted, recoverable depreciation is released on replacement‑cost claims. To keep momentum:

– Save receipts for materials and labor, and keep communications in one place.

– Ask whether preferred contractors are available or whether you can use your own.

– Clarify whether code upgrades fall under ordinance coverage before work begins.

These steps help prevent delays and ensure you receive what the policy promises under the chosen valuation method.

Pricing, Shopping Strategy, and Practical Comparisons

Premiums vary widely because underwriters price the probability and size of loss for each address. Primary drivers include location (fire protection class, crime patterns, weather), construction type (frame, masonry, mixed), age and updates (roof, wiring, plumbing, heating), occupancy (single‑family, duplex, multi‑unit), intended use (long‑term vs short‑term rental), prior losses, and the coverage profile you select. Deductibles, liability limits, and add‑ons like water backup or equipment breakdown also shift the cost. In many markets, an annual premium for a single‑family rental can range from a few hundred to several thousand units of currency depending on these factors, with coastal or severe‑storm regions typically on the higher end.

Think in terms of value, not just price. A lean policy may look attractive until you map it against plausible losses. Consider a quick comparison:

– Owner A chooses a low dwelling limit, ACV valuation, minimal loss of rent, and a high wind deductible.

– Owner B insures to replacement cost, adds ordinance or law and water backup, and carries higher liability with a modest deductible.

If a supply line bursts and soils a kitchen and two rooms below, Owner A may face depreciation cuts and limited rent coverage that fail to match contractor bids, while Owner B is positioned to recover closer to actual rebuild costs and to replace lost income during repairs.

Shopping tips that keep you in control:

– Decide on must‑have endorsements up front (ordinance, water backup) and request quotes both with and without them to see the true price difference.

– Calibrate deductibles to your cash reserves; a deductible you can’t comfortably pay is a false economy.

– Provide accurate, verifiable details on updates; documented roof and electrical upgrades can materially improve offers.

– Ask how defense costs apply to liability (inside vs outside limits) and whether special deductibles apply to wind or hail.

You can also shape premiums through risk improvements. Well‑lit entries, sturdy handrails, GFCI outlets near water, leak sensors in key areas, and routine roof maintenance lower claim likelihood. Some carriers may recognize these steps with favorable terms or pricing, but even when they don’t, the reduction in downtime and disputes has real value. Finally, keep an annual checklist:

– Re‑confirm rebuild cost assumptions and adjust limits.

– Review lease language and require proof of tenant insurance where permitted.

– Update photos and maintenance logs to create a clean claims record.

A disciplined approach can turn a complex purchase into a straightforward business decision, aligning coverage with your appetite for risk and your long‑term investment goals.